Managing finances can be complex and time-consuming. Financial management software can simplify the process.

In today’s fast-paced world, effective financial management is crucial. Personal and business finances need careful planning and monitoring. Financial management software offers a solution. It helps track expenses, manage budgets, and analyze financial data with ease. This software can improve financial health and save time.

Whether for personal use or business, it streamlines financial tasks. This means fewer errors and better decision-making. With various options available, finding the right software can seem daunting. This guide will help you understand the benefits and features of financial management software. Dive in to see how it can simplify your financial tasks and enhance your financial well-being.

Importance Of Financial Management

Financial management is the backbone of any successful business. Efficient handling of finances ensures smooth operations, sustainability, and growth. Financial Management Software plays a crucial role in achieving these goals. It streamlines financial processes, enhances accuracy, and provides valuable insights. Understanding the importance of financial management can significantly impact the overall performance of a business.

Benefits For Businesses

Financial Management Software offers various benefits that can transform the way businesses handle their finances. Here are some key advantages:

- Time-Saving: Automates routine tasks such as invoicing, payroll, and tax calculations, freeing up valuable time.

- Accuracy: Reduces human errors by automating data entry and calculations.

- Cost Efficiency: Minimizes the need for extensive paperwork and reduces administrative costs.

- Real-Time Financial Insights: Provides up-to-date financial data, aiding in better decision-making.

- Compliance: Ensures adherence to financial regulations and standards, reducing the risk of penalties.

Businesses can also benefit from improved cash flow management. The software helps in tracking receivables and payables, ensuring timely payments. This improves relationships with suppliers and customers. Additionally, businesses can better plan their budgets and forecast future financial trends.

| Benefit | Description |

|---|---|

| Time-Saving | Automates routine tasks, freeing up time for strategic activities. |

| Accuracy | Reduces human errors through automation. |

| Cost Efficiency | Minimizes paperwork and reduces administrative costs. |

| Real-Time Financial Insights | Provides current financial data for informed decisions. |

| Compliance | Ensures adherence to financial regulations and standards. |

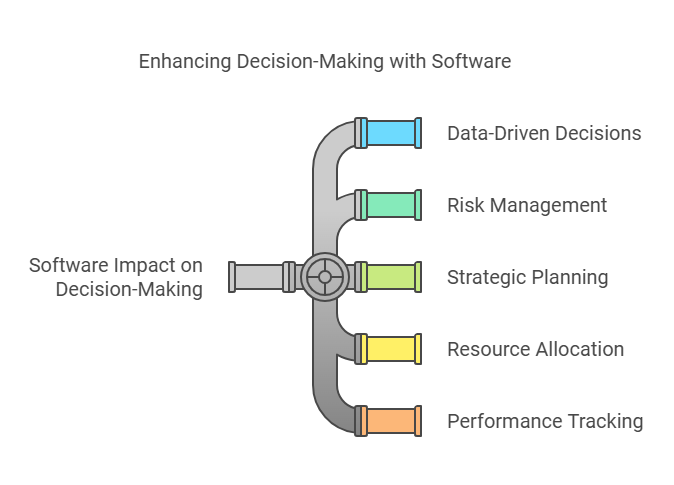

Impact On Decision Making

Financial Management Software significantly impacts decision-making processes within a business. With accurate and real-time data, businesses can make informed decisions quickly. This is crucial for maintaining a competitive edge in today’s fast-paced market.

Here are some ways the software enhances decision-making:

- Data-Driven Decisions: Provides detailed financial reports and analytics, enabling data-driven decisions.

- Risk Management: Identifies financial risks early, allowing businesses to take proactive measures.

- Strategic Planning: Assists in long-term financial planning and strategy formulation.

- Resource Allocation: Helps allocate resources efficiently based on financial data.

- Performance Tracking: Monitors financial performance, helping in setting and achieving financial goals.

Having real-time access to financial data allows businesses to respond swiftly to market changes. This agility can be the difference between capitalizing on opportunities and missing them. The software also helps in predicting future trends, which is vital for strategic planning. Businesses can set realistic goals and develop actionable plans to achieve them.

Types Of Financial Management Software

Financial Management Software helps businesses manage their financial activities efficiently. There are various types of financial management software designed to cater to different needs. Understanding these types can help you choose the right tools for your business. Below are some key types of financial management software.

Accounting Software

Accounting software is crucial for any business. It helps manage and automate financial transactions. This type of software tracks income, expenses, and ensures accurate financial reporting.

Key features of accounting software include:

- Automated Invoicing: Generates and sends invoices automatically.

- Expense Tracking: Keeps track of business expenses.

- Financial Reporting: Produces financial statements and reports.

- Tax Management: Helps prepare and file taxes.

Here’s a quick comparison of popular accounting software:

| Software | Best For | Price |

|---|---|---|

| QuickBooks | Small to Medium Businesses | $25/month |

| Xero | Multi-currency Transactions | $20/month |

| FreshBooks | Freelancers | $15/month |

Budgeting Tools

Budgeting tools are essential for planning and managing finances. They help businesses set financial goals and track progress.

Common features of budgeting tools include:

- Goal Setting: Define financial goals for the business.

- Expense Allocation: Allocate funds to different business areas.

- Forecasting: Predict future financial performance.

- Reporting: Generate budget reports to monitor progress.

Top budgeting tools and their features:

| Tool | Key Feature | Price |

|---|---|---|

| YNAB (You Need A Budget) | Real-time Expense Tracking | $11.99/month |

| Mint | Personalized Insights | Free |

| Personal Capital | Investment Tracking | Free |

Expense Tracking

Expense tracking software helps businesses monitor and control their spending. It provides insights into where money is going and helps identify cost-saving opportunities.

Important features of expense tracking software:

- Receipt Scanning: Capture and store receipts digitally.

- Category Tracking: Categorize expenses for better analysis.

- Reimbursement Management: Manage employee reimbursements.

- Real-time Reporting: Access up-to-date expense reports.

Popular expense tracking software and their benefits:

| Software | Best For | Price |

|---|---|---|

| Expensify | Automated Expense Reports | $5/user/month |

| Shoeboxed | Receipt Management | $18/month |

| Concur | Corporate Expense Management | Custom Pricing |

Key Features To Look For

Financial management software helps businesses manage their finances efficiently. Knowing which features to look for in the software can make a big difference. Here are some key features to consider when choosing financial management software.

User-friendly Interface

A user-friendly interface is crucial. It ensures that users can navigate the software with ease. A good interface is intuitive and easy to understand. This reduces the learning curve for new users and minimizes errors. Here are some features to look for:

- Clear Navigation: Menus and options should be easy to find.

- Simple Dashboard: A dashboard that shows key information at a glance.

- Customization Options: Users should be able to customize their view.

- Accessibility: The software should be accessible on various devices.

Consider the following example table for interface evaluation:

| Feature | Description |

|---|---|

| Clear Navigation | Menus and options are easy to find. |

| Simple Dashboard | Key information is visible at a glance. |

| Customization Options | Users can tailor their view. |

| Accessibility | Accessible on various devices. |

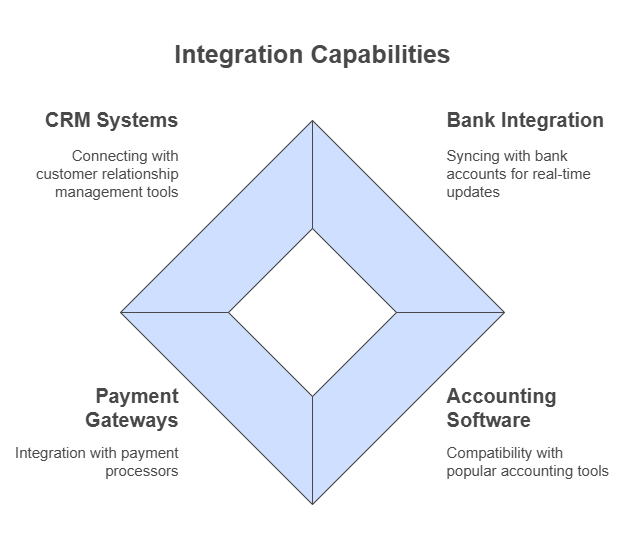

Integration Capabilities

Integration capabilities are vital. Financial management software should work well with other tools. This makes it easier to streamline processes. Key integrations to look for include:

- Bank Integration: Syncing with bank accounts for real-time updates.

- Accounting Software: Compatibility with popular accounting tools.

- Payment Gateways: Integration with payment processors.

- CRM Systems: Connecting with customer relationship management tools.

Integration capabilities allow for seamless data flow. This reduces manual data entry and the risk of errors. It also ensures that all systems are up-to-date. Here is a brief summary in table form:

| Integration | Benefit |

|---|---|

| Bank Integration | Real-time financial updates. |

| Accounting Software | Compatibility with existing tools. |

| Payment Gateways | Seamless payment processing. |

| CRM Systems | Better customer data management. |

Reporting Tools

Effective reporting tools are essential. They help in making informed decisions. Look for software that offers:

- Customizable Reports: Ability to create reports tailored to your needs.

- Real-Time Data: Access to up-to-date financial information.

- Visual Reports: Charts and graphs for easy understanding.

- Export Options: Export reports in various formats like PDF and Excel.

Reporting tools provide insights into financial health. They help track performance and identify trends. Well-designed reports can highlight areas needing attention. Here’s a summary table:

| Feature | Benefit |

|---|---|

| Customizable Reports | Tailored insights. |

| Real-Time Data | Up-to-date information. |

| Visual Reports | Easy to understand. |

| Export Options | Flexible sharing. |

Top Financial Management Software

Financial Management Software helps businesses manage their financial operations. It includes tools for budgeting, accounting, and reporting. Here are some top financial management software options available today.

Popular Choices

These software options are well-known and widely used by businesses worldwide:

- QuickBooks: Designed for small to mid-sized businesses. It offers invoicing, expense tracking, payroll, and financial reporting. QuickBooks is user-friendly and integrates with many other business apps.

- FreshBooks: Ideal for freelancers and small businesses. It provides features for invoicing, expense tracking, time tracking, and project management. FreshBooks also supports online payments.

- Xero: Suitable for small to large businesses. It includes bank reconciliation, invoicing, inventory management, and financial reporting. Xero integrates with over 800 business apps.

These popular choices are preferred for their reliability and feature-rich platforms. Many businesses find them easy to use and integrate with existing systems. They offer comprehensive solutions for various financial tasks.

Emerging Solutions

These newer software options are gaining popularity for their innovative features:

- Zoho Books: A robust option for small to mid-sized businesses. It offers features like invoicing, expense tracking, project management, and inventory management. Zoho Books integrates well with other Zoho applications.

- Wave: A free financial management tool for small businesses. It includes accounting, invoicing, and receipt scanning. Wave also offers payroll and payment processing services at an additional cost.

- Bill.com: Focuses on automating accounts payable and receivable. It simplifies bill payments, invoicing, and approvals. Bill.com integrates with popular accounting software like QuickBooks and Xero.

These emerging solutions are gaining traction due to their unique features and competitive pricing. They cater to various business sizes and needs, offering flexibility and innovation in financial management.

Cost Considerations

When choosing financial management software, cost is a crucial factor. It’s important to understand what you are paying for and how it fits into your budget. Different pricing models and hidden fees can impact your decision. This guide will help you navigate these cost considerations.

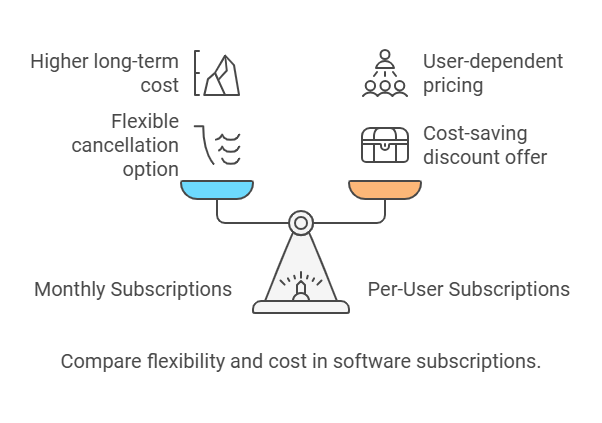

Subscription Models

Financial management software usually follows a subscription model. This means you pay a recurring fee to use the software. There are different types of subscription plans:

- Monthly Subscriptions: These plans offer flexibility. You can cancel anytime if you’re not satisfied. They are usually more expensive in the long run.

- Annual Subscriptions: These plans often come with a discount. You commit to using the software for a year. This can save money if you plan to use the software long-term.

- Per-User Subscriptions: The cost depends on the number of users. This is suitable for businesses with multiple employees needing access.

Here’s a comparison table for a better understanding:

| Subscription Type | Pros | Cons |

|---|---|---|

| Monthly | Flexible, Cancel anytime | Higher long-term cost |

| Annual | Discounted, Cost-effective long-term | Yearly commitment |

| Per-User | Scalable with business size | Potentially high cost for large teams |

Hidden Fees

Besides the subscription fee, there may be hidden fees. These can increase your total cost unexpectedly. Be aware of the following potential hidden charges:

- Setup Fees: Some software providers charge an initial setup fee. This covers the cost of getting your account ready.

- Training Fees: If you need training to use the software, you might have to pay extra. This cost can add up if multiple employees need training.

- Support Fees: Basic support might be free. For premium support, you may need to pay extra. This can include 24/7 support or dedicated account managers.

- Upgrade Fees: Basic versions might be cheaper. If you need advanced features, you might have to upgrade, which costs more.

Understanding these hidden fees is crucial. Ask the provider about all possible charges. This will help you make an informed decision.

Implementation Process

Implementing Financial Management Software can significantly improve your business operations. This process involves a series of steps to ensure the software is properly installed, and your team is ready to use it efficiently. The key stages include setting up the software and training employees.

Setting Up Software

Setting up financial management software involves several crucial steps. Proper setup ensures the software functions smoothly and meets your business needs.

Initial Setup: This involves installing the software on your systems. Ensure your hardware meets the software’s requirements.

- Check system compatibility

- Install necessary drivers and updates

- Run initial diagnostics

Configuration: Configure the software to align with your business processes. This might include setting up user roles, permissions, and workflows.

- Define user roles and access levels

- Customize workflows to match your operations

- Set up data import templates

Data Migration: Migrate your existing financial data to the new system. This step is crucial for maintaining continuity and accuracy.

| Step | Description |

|---|---|

| Data Backup | Backup your current data before migration |

| Data Mapping | Map old data fields to new system fields |

| Data Validation | Validate data for accuracy and completeness |

Training Employees

Training employees ensures they can use the financial management software efficiently. This step is critical for maximizing the software’s benefits.

Training Sessions: Organize training sessions for different user groups. Tailor these sessions to the specific roles and responsibilities of each group.

- Conduct sessions for finance team

- Include sessions for management

- Offer basic training for other staff

Hands-On Practice: Provide hands-on practice to help employees get comfortable with the software. Real-life scenarios can be very helpful.

- Create sample transactions

- Simulate financial reporting

- Practice data entry and validation

Support Resources: Offer support resources to assist employees post-training. These can be in the form of manuals, FAQs, or help desks.

Support resources may include:

- Step-by-step user manuals

- Frequently Asked Questions (FAQs)

- Access to a help desk or support team

Effective training ensures that employees are confident and proficient in using the financial management software. This will lead to smoother operations and better financial management.

Common Challenges

Managing finances is crucial for any business. Financial Management Software (FMS) helps streamline this process. It automates tasks, improves accuracy, and provides real-time insights. Yet, implementing FMS comes with challenges. Let’s explore some common ones.

Data Migration Issues

Data migration is moving data from one system to another. It is a common challenge in FMS implementation. Here are some reasons why:

- Data Incompatibility: Old systems may use different formats. Converting these formats can be complex.

- Data Loss: There’s a risk of losing data during the transfer.

- Time-Consuming: The process can take much time, impacting business operations.

- Quality Issues: Inaccurate data can lead to poor decision-making.

To minimize these issues, businesses should:

- Plan the migration process carefully.

- Test the data after migration.

- Use specialized tools for data conversion.

- Ensure data quality and integrity.

Here’s a comparison table for better understanding:

| Old System | New System |

|---|---|

| Different Data Formats | Unified Data Format |

| Manual Data Entry | Automated Data Entry |

| High Error Rate | Low Error Rate |

User Resistance

User resistance is another common challenge. Employees may resist using new software due to:

- Lack of Familiarity: Users are comfortable with the old system.

- Fear of Change: Changes can be intimidating.

- Lack of Training: Insufficient training can hinder adoption.

- Perceived Complexity: New systems may seem complex.

To overcome user resistance, businesses should:

- Provide comprehensive training.

- Highlight the benefits of the new system.

- Involve users in the implementation process.

- Offer continuous support and resources.

Here are some benefits of addressing user resistance:

| Without Addressing | With Addressing |

|---|---|

| Low Adoption Rate | High Adoption Rate |

| Poor User Experience | Enhanced User Experience |

| Decreased Productivity | Increased Productivity |

Effective strategies can ease the transition and ensure the success of FMS implementation.

Future Trends

Financial management software is evolving rapidly. Future trends in this field are set to redefine how businesses manage their finances. These trends promise increased efficiency, better data management, and enhanced decision-making capabilities. Let’s explore some of these exciting trends that will shape the future of financial management software.

Ai And Automation

Artificial Intelligence (AI) and automation are changing the landscape of financial management. AI helps in analyzing vast amounts of data quickly and accurately. Automation streamlines repetitive tasks, freeing up time for more strategic activities.

Here are some key benefits of AI and automation in financial management software:

- Improved Accuracy: AI reduces human error by handling data-intensive tasks.

- Cost Savings: Automation cuts down on manual labor, reducing operational costs.

- Better Decision-Making: AI provides insights and predictions, helping businesses make informed decisions.

Consider a scenario where AI and automation play a pivotal role:

| Task | Traditional Method | AI and Automation |

|---|---|---|

| Data Entry | Manual input, prone to errors | Automated, accurate, and fast |

| Data Analysis | Time-consuming, requires human intervention | Real-time analysis, AI-driven insights |

By embracing AI and automation, businesses can transform their financial operations, making them more efficient and reliable.

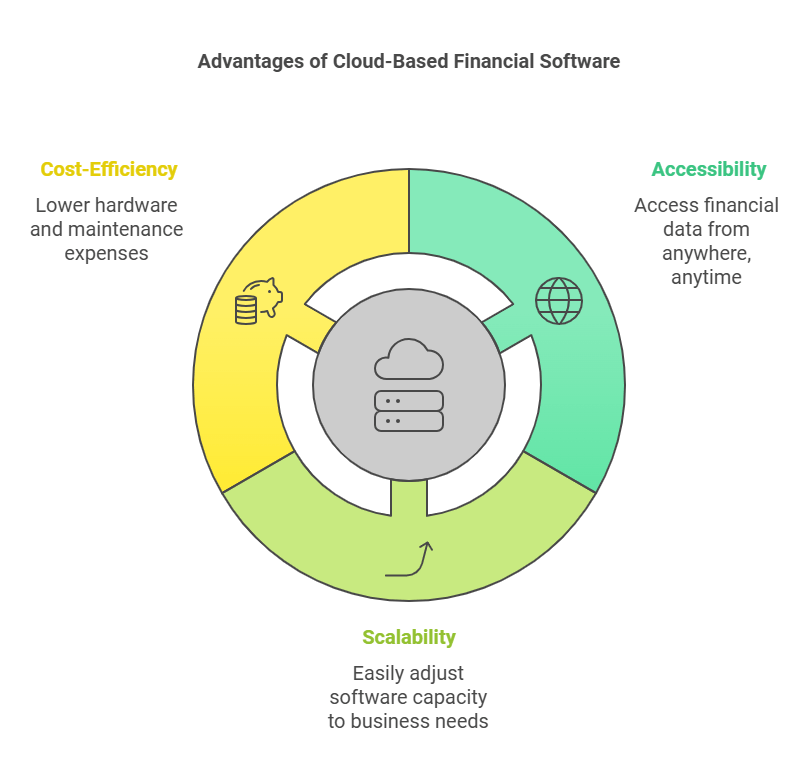

Cloud-based Solutions

Cloud-based solutions are becoming the norm in financial management software. They offer flexibility, scalability, and accessibility, making them a preferred choice for many businesses.

Here are some advantages of cloud-based financial management software:

- Accessibility: Access your financial data from anywhere, anytime.

- Scalability: Easily scale up or down based on your business needs.

- Cost-Efficiency: Reduce hardware and maintenance costs.

Cloud-based solutions also enhance collaboration within teams. Multiple users can work on the same financial data simultaneously, improving teamwork and productivity.

Let’s take a look at a comparison between traditional and cloud-based financial management solutions:

| Feature | Traditional Software | Cloud-Based Software |

|---|---|---|

| Accessibility | Limited to office network | Accessible from anywhere |

| Maintenance | Requires regular updates | Automatic updates |

Cloud-based solutions are not just a trend but a necessity for modern businesses. They ensure that financial management is smooth, efficient, and adaptable to changing business environments.

Frequently Asked Questions

What Is Financial Management Software?

Financial management software helps individuals and businesses manage their finances. It tracks income, expenses, and budgets efficiently. This software can also generate financial reports and assist in planning.

How Does Financial Management Software Work?

Financial management software automates financial tasks. It records transactions, categorizes expenses, and creates budgets. It also provides real-time financial insights and reports.

Why Use Financial Management Software?

Using financial management software saves time and increases accuracy. It helps manage budgets, track expenses, and generate financial reports effortlessly. This software ensures better financial planning and control.

What Features Should Financial Management Software Have?

Financial management software should include budgeting, expense tracking, and financial reporting features. It should also offer bank integration, security, and user-friendly interfaces.

Conclusion

Financial management software simplifies your financial tasks. It offers clear insights. This helps in making better financial decisions. With automated tracking, you save time. It reduces errors. Your finances stay organized. Businesses and individuals benefit alike. Choosing the right software is crucial.

It should meet your specific needs. Research and compare options carefully. Find the best fit. Enjoy peace of mind and financial clarity.