Managing business expenses can be a daunting task. QuickBooks offers a powerful solution for tracking these expenses with ease.

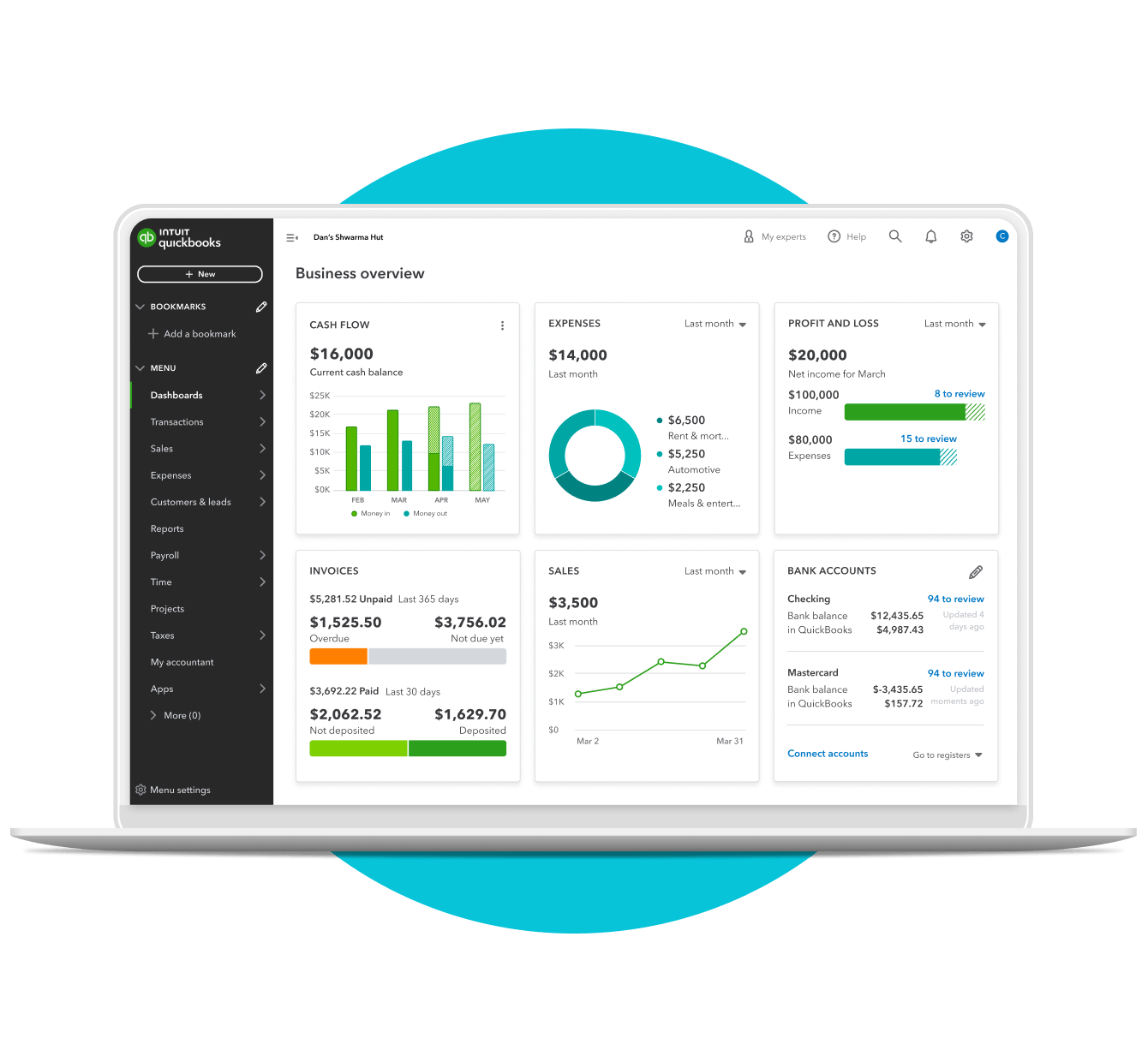

QuickBooks Expense Tracking simplifies managing your finances. It helps you keep track of every penny. This tool is perfect for small businesses and entrepreneurs. With QuickBooks, you can categorize expenses, monitor cash flow, and generate detailed reports. This means you can focus more on growing your business and less on paperwork.

Understanding your spending patterns is crucial. QuickBooks provides the insights you need. Efficient expense tracking can save you time and money. It also ensures better financial health for your business. Ready to learn more about QuickBooks Expense Tracking? Let’s dive into how it can benefit your business.

Credit: www.docuclipper.com

Introduction To Quickbooks

Managing your business finances can be a daunting task. QuickBooks simplifies this process with its powerful expense tracking features. This blog post provides an introduction to QuickBooks and its many benefits for expense tracking.

What Is Quickbooks?

QuickBooks is a popular accounting software designed for small and medium-sized businesses. It helps manage various financial tasks such as tracking expenses, creating invoices, and generating financial reports. Its user-friendly interface makes it easy for non-accountants to use.

Here are some of the key features of QuickBooks:

- Expense Tracking: Track all your business expenses in one place.

- Invoicing: Create and send professional invoices to clients.

- Financial Reporting: Generate detailed financial reports to understand your business’s financial health.

- Bank Reconciliation: Match your bank transactions with your records.

- Payroll Management: Manage employee payroll easily.

QuickBooks offers various versions, including QuickBooks Online and QuickBooks Desktop. Each version has its own set of features tailored to different business needs. Whether you are a freelancer or run a small business, QuickBooks has a solution for you.

Benefits Of Using Quickbooks

Using QuickBooks for expense tracking offers numerous benefits. Here are some of the most significant ones:

- Time-Saving: Automate repetitive tasks, such as expense categorization and report generation.

- Accuracy: Reduce human errors with automated calculations and data entry.

- Real-Time Data: Access up-to-date financial information anytime, anywhere.

- Customization: Tailor the software to fit your specific business needs with customizable reports and invoices.

- Integration: Connect with other business tools like payroll services and payment processors.

QuickBooks also offers excellent customer support and a vast community of users. You can find answers to your questions quickly, either through QuickBooks support or community forums. This means you can resolve issues faster and keep your business running smoothly.

Overall, QuickBooks is a comprehensive solution for managing your business finances efficiently. Its powerful features and user-friendly interface make it a top choice for businesses of all sizes.

Credit: www.businesswire.com

Setting Up Quickbooks For Expenses

Tracking expenses in QuickBooks can significantly streamline your financial management. Setting up QuickBooks for expenses ensures you can easily monitor and categorize your spending. This not only helps in maintaining accurate records but also aids in making informed business decisions.

Creating An Account

To start using QuickBooks for expense tracking, you first need to create an account. Follow these simple steps to get started:

- Visit the QuickBooks website and click on the “Sign Up” or “Try it Free” button.

- Enter your email address and create a strong password.

- Fill in your business details, including the name, industry, and type of business.

- Choose the QuickBooks plan that best suits your needs.

- Enter your payment information, if required, and complete the sign-up process.

Once your account is created, you can start setting up your expense tracking system. QuickBooks offers various features to help you manage your expenses efficiently. Below are some tips to make the most of your QuickBooks account:

- Connect your bank accounts: Link your business bank accounts and credit cards to QuickBooks. This allows for automatic import of transactions, saving time and reducing errors.

- Set up user permissions: If multiple people will be using QuickBooks, set up user roles and permissions. This ensures that only authorized personnel can access sensitive financial data.

- Use the mobile app: Download the QuickBooks mobile app to track expenses on the go. This is especially useful for recording expenses incurred during business trips.

Configuring Expense Categories

Properly configuring expense categories in QuickBooks is crucial for accurate financial reporting. Here’s how to set up and customize your expense categories:

1. Navigate to the Chart of Accounts: Go to the ‘Accounting’ menu and select ‘Chart of Accounts’. This is where you can view and manage your expense categories.

2. Add new categories: Click on the ‘New’ button to create a new expense category. Choose ‘Expense’ as the account type and enter a name for the category. You can also add a description to provide more details.

3. Customize existing categories: QuickBooks comes with default categories, but you can customize them to fit your business needs. Edit the category names and descriptions as necessary.

4. Organize sub-categories: Create sub-categories to further organize your expenses. For example, under ‘Travel’, you can have sub-categories like ‘Airfare’, ‘Hotel’, and ‘Meals’.

Below is an example of how you might organize your expense categories:

| Category | Sub-Category |

|---|---|

| Travel | Airfare, Hotel, Meals |

| Office Supplies | Stationery, Electronics, Furniture |

| Utilities | Electricity, Water, Internet |

By configuring these categories, you can generate detailed expense reports, making it easier to track where your money is going. This organization helps you identify areas where you can cut costs or need to increase spending. Keeping your expense categories well-organized ensures your financial records are clear and accurate.

Tracking Expenses Efficiently

Quickbooks makes expense tracking simple and efficient. Accurately tracking expenses is crucial for managing your finances. Quickbooks offers both manual and automated methods to ensure you never miss a detail. Let’s dive into how you can track expenses efficiently with Quickbooks.

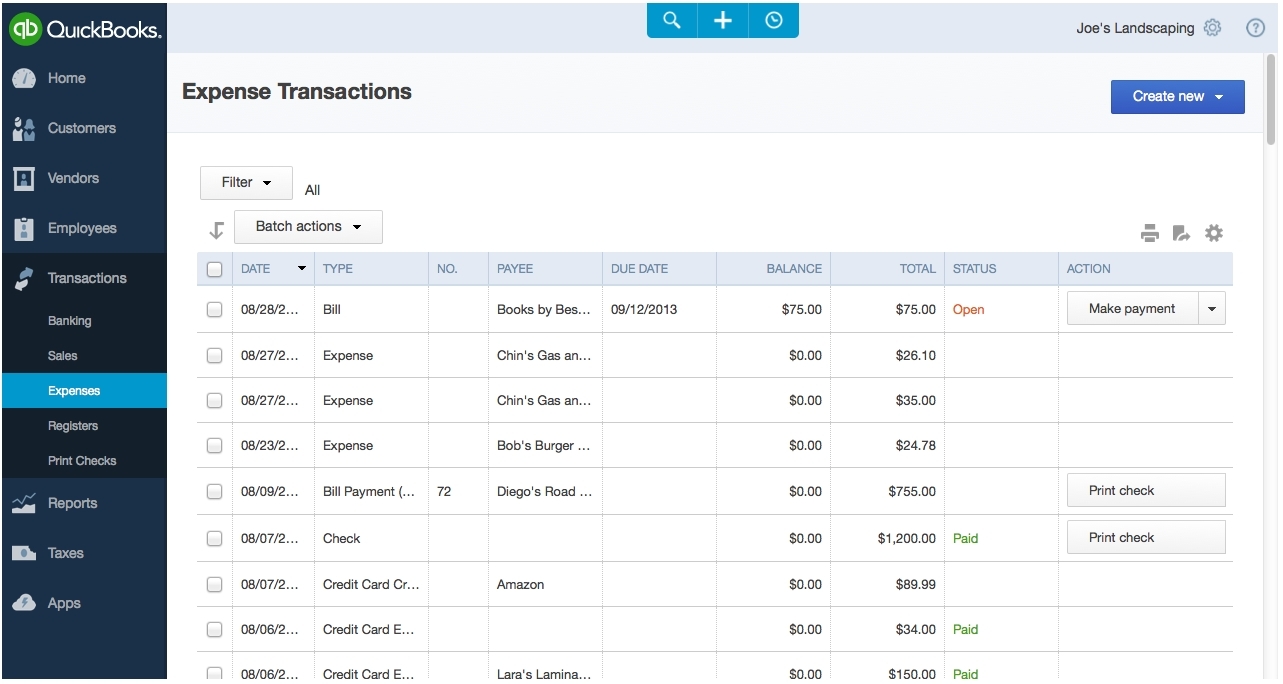

Manual Entry Methods

Manual entry methods in Quickbooks allow you to input expenses directly. This method is useful for small businesses with fewer transactions.

Here are some ways you can manually enter expenses:

- Expense Form: Use the expense form to record purchases. Enter details like date, amount, and vendor.

- Check Register: This method lets you enter expenses as checks. It’s useful for businesses that primarily use checks.

- Journal Entries: Record expenses by creating journal entries. This is best for more complex transactions.

Manual entry allows for detailed tracking. Each expense can be categorized and tagged for easy reference. For example:

| Date | Amount | Category | Vendor |

|---|---|---|---|

| 01/01/2023 | $150 | Office Supplies | Staples |

| 01/05/2023 | $300 | Travel | Uber |

While manual entry requires more effort, it offers greater control over each transaction. You can ensure every detail is captured accurately.

Automated Tracking Features

Automated tracking features in Quickbooks save time and reduce errors. They are ideal for businesses with many transactions.

Here are some automated tracking features in Quickbooks:

- Bank Feeds: Connect your bank account to Quickbooks. Transactions are imported automatically. You can categorize them with a few clicks.

- Receipt Capture: Use your phone to take pictures of receipts. Quickbooks extracts details and matches them to transactions.

- Recurring Transactions: Set up recurring expenses like rent or subscriptions. Quickbooks records them automatically each period.

![]()

Automated features streamline the expense tracking process. They minimize manual data entry and reduce the risk of errors. For instance:

| Feature | Benefit |

|---|---|

| Bank Feeds | Automatic import of transactions |

| Receipt Capture | Quick matching of receipts to expenses |

| Recurring Transactions | Automatic recording of regular expenses |

Using automated tracking features, you can save time and focus on growing your business. Quickbooks ensures your expense tracking is accurate and up-to-date.

Integrating Bank Accounts

QuickBooks Expense Tracking makes managing your finances easier. One of its best features is integrating bank accounts. This feature saves time and reduces errors. You can keep a close eye on your expenses. Let’s explore how to integrate your bank accounts with QuickBooks.

Linking Accounts

Linking your bank accounts to QuickBooks is simple. Follow these steps:

- Open QuickBooks and go to the Banking menu.

- Click on “Add Account”.

- Select your bank from the list or search for it.

- Enter your bank login details.

- Follow the prompts to link your account.

Once linked, QuickBooks will start fetching your transactions. This automated process reduces manual data entry. It also helps prevent mistakes.

Here are some benefits of linking your bank accounts:

| Benefit | Description |

|---|---|

| Time-saving | No more manual data entry. |

| Accuracy | Reduce human errors. |

| Real-time updates | See your transactions instantly. |

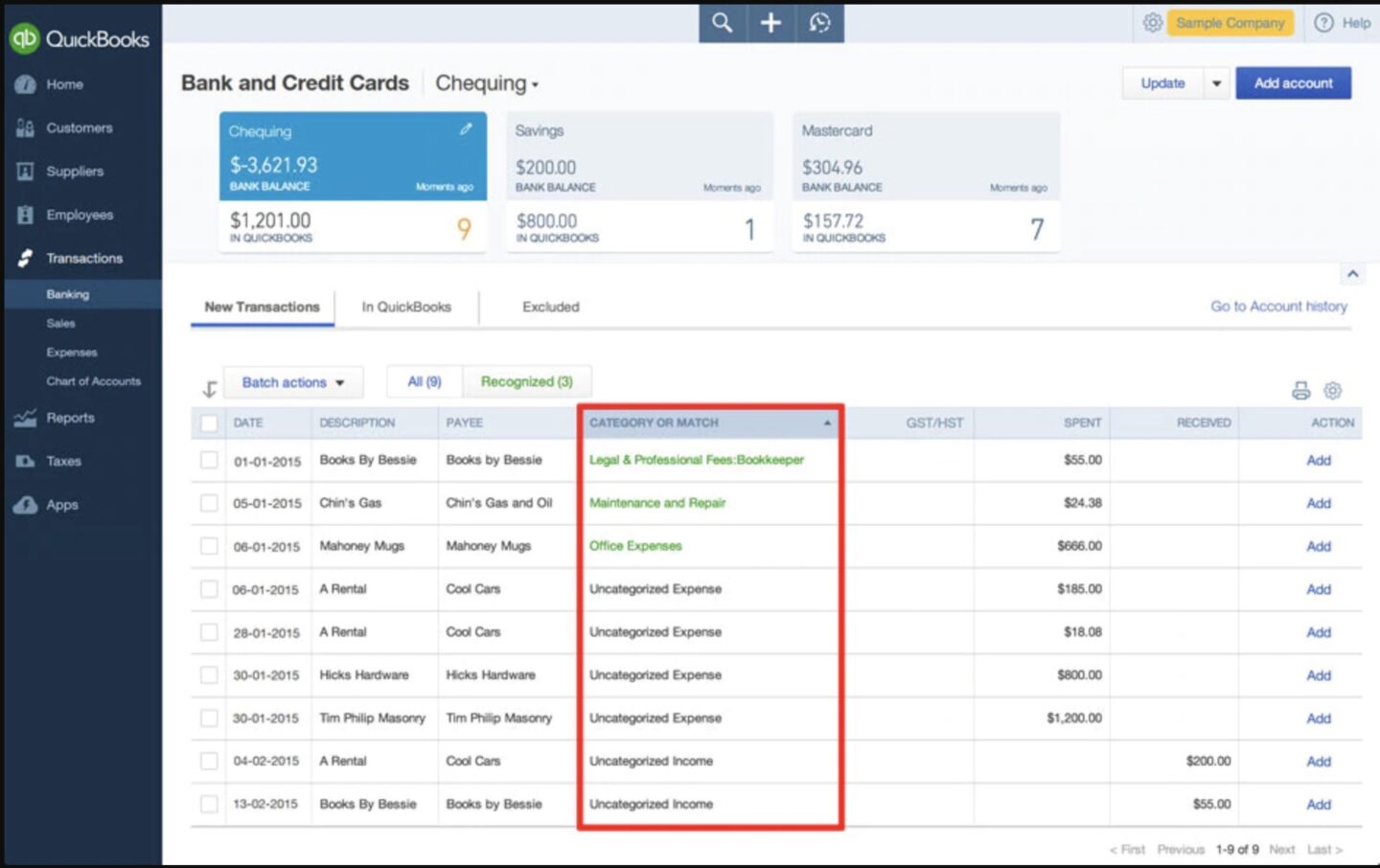

Importing Transactions

Importing transactions into QuickBooks is another great feature. Here’s how you can do it:

- Go to the Banking menu.

- Select your linked account.

- Click “Update” to fetch the latest transactions.

- Review the transactions and categorize them.

- Click “Add” to import them into QuickBooks.

This process ensures your records stay up-to-date. You can import transactions from various sources such as:

- Bank accounts

- Credit cards

- PayPal

Importing transactions helps in several ways:

- Track expenses easily

- Monitor your cash flow

- Prepare accurate financial reports

With these features, you can manage your finances more effectively. QuickBooks makes expense tracking simple and efficient.

Using Receipts In Quickbooks

Tracking expenses is crucial for any business. QuickBooks makes this task easier with its receipt management feature. Using receipts in QuickBooks can streamline your expense tracking process, ensuring you stay organized and compliant. Let’s dive into how you can effectively use this feature.

Uploading Receipts

Uploading receipts in QuickBooks is simple and efficient. You can upload receipts directly from your computer or through the QuickBooks mobile app. Here are some steps to help you get started:

On your computer:

- Log in to your QuickBooks account.

- Navigate to the ‘Receipts’ tab under the ‘Banking’ menu.

- Click on the ‘Upload from computer’ button.

- Select the receipt file from your computer and upload it.

- QuickBooks will automatically scan and extract the data from the receipt.

Using the mobile app:

- Open the QuickBooks mobile app on your phone.

- Tap the ‘+’ icon and select ‘Receipt photo’.

- Take a clear photo of your receipt.

- Review and confirm the details before saving.

- Your receipt will be uploaded to your QuickBooks account.

Uploading receipts digitally helps you avoid losing important documents. It also saves time by automating data entry. QuickBooks’ OCR (Optical Character Recognition) technology extracts relevant information, reducing manual work.

Organizing Receipts

Once your receipts are uploaded, organizing them is the next step. QuickBooks provides several tools to keep your receipts in order:

Create categories:

- Go to the ‘Receipts’ tab.

- Click on ‘Create a new category’.

- Name the category based on your business needs (e.g., Travel, Office Supplies).

- Assign receipts to these categories for better organization.

Match receipts to transactions:

- QuickBooks can match uploaded receipts to existing transactions automatically.

- Review these matches to ensure accuracy.

- If a match is incorrect, you can manually link the receipt to the right transaction.

Use tags:

- Tags help in further sorting and filtering your receipts.

- Add tags such as ‘Client Meeting’, ‘Project A’, etc., for more detailed tracking.

Organizing receipts in QuickBooks not only helps in keeping records tidy but also aids in better financial reporting. Properly categorized and tagged receipts make it easier to generate accurate expense reports and prepare for tax season.

Credit: quickbooks.intuit.com

Generating Expense Reports

Tracking expenses is crucial for any business. QuickBooks makes this task easier by offering a robust expense tracking feature. Generating expense reports with QuickBooks helps you understand where your money goes. It provides insights into your spending patterns and helps you make informed decisions.

Creating Custom Reports

QuickBooks allows you to create custom expense reports tailored to your needs. These reports help you see detailed information about your expenses. Follow these steps to create a custom report:

- Go to the Reports section in QuickBooks.

- Select Custom Reports.

- Choose the type of report you want to create, such as Expense by Vendor or Expense by Category.

- Set the date range for the report.

- Filter the data based on your specific needs.

- Click Run Report to generate the report.

Custom reports give you flexibility. You can filter data by:

- Vendor

- Category

- Amount

- Date

This helps you see exactly what you need. QuickBooks also allows you to save your custom reports. This makes it easy to run them again in the future. You can export these reports to Excel or PDF. This enables you to share them with your team or accountant.

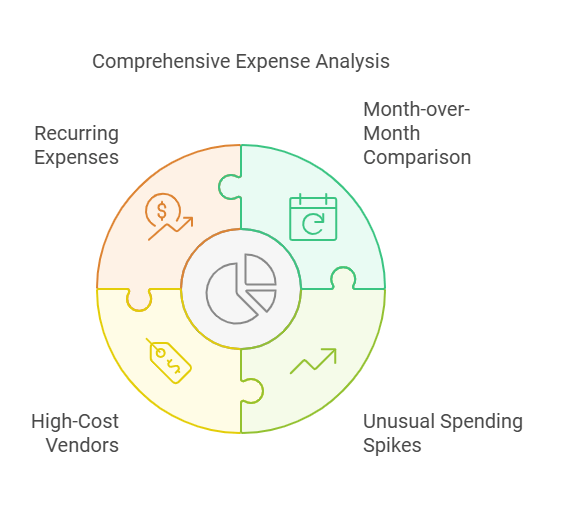

Analyzing Expenses

Once you have generated your expense reports, it’s time to analyze the data. This helps you understand your spending habits. Here are some tips for analyzing your expenses:

- Compare expenses month over month.

- Look for any unusual spikes in spending.

- Identify vendors that cost you the most.

- Check for recurring expenses that you can reduce or eliminate.

QuickBooks also offers visual tools. These include charts and graphs. They help you see your expense data in a clear way. Here is an example:

| Month | Total Expenses |

|---|---|

| January | $5,000 |

| February | $4,500 |

| March | $6,000 |

From the table, you can see the trends in your spending. If expenses are rising, you can investigate why. This helps you control costs.

Analyzing expenses helps you make better financial decisions. It shows you where you can cut costs and save money. This is vital for the health of your business.

Common Issues And Solutions

QuickBooks Expense Tracking is a vital tool for managing your finances. It helps keep track of every penny spent and ensures that your books are accurate. Yet, many users face common issues that can disrupt their workflow. Understanding these problems and how to solve them can save time and frustration. Here, we will explore some common issues and their solutions.

Troubleshooting Errors

Errors can occur frequently in QuickBooks Expense Tracking. Knowing how to troubleshoot them can make your experience much smoother.

- Data entry errors: Incorrect data entry can lead to inaccurate records. Double-check your entries before saving.

- Connection issues: Ensure a stable internet connection to avoid syncing problems.

- Software updates: Outdated software can cause errors. Always keep QuickBooks updated.

Here are some common error messages and solutions:

| Error Message | Solution |

|---|---|

| Missing Transactions | Check for any filters applied that may hide transactions. |

| Duplicate Entries | Use the “Find Duplicates” feature to remove duplicates. |

| Sync Errors | Reconnect your bank account and refresh the connection. |

By following these steps, many errors can be resolved quickly. Regular maintenance and careful entry can prevent most issues.

Best Practices For Accuracy

Maintaining accuracy in QuickBooks Expense Tracking ensures reliable financial data. Follow these best practices to keep your records precise:

- Regular Reconciliation: Reconcile your accounts monthly to catch discrepancies early.

- Consistent Categorization: Use consistent categories for expenses to avoid confusion.

- Receipt Management: Attach receipts to transactions for easy verification.

- Automate Entries: Use automation features to reduce manual data entry errors.

- Set Reminders: Set reminders for regular reviews and reconciliation.

Here are some tips to enhance accuracy:

- Review Reports: Regularly review financial reports to spot inconsistencies.

- Use Bank Feeds: Link your bank account for automatic transaction updates.

- Train Users: Ensure all users are trained on how to enter data correctly.

Accuracy in QuickBooks can save time and prevent costly errors. Implement these practices to maintain a smooth and reliable tracking system.

Advanced Expense Tracking Tips

Expense tracking is vital for managing your business finances. QuickBooks offers powerful tools to streamline this process. Knowing advanced expense tracking tips can help you maximize the potential of QuickBooks. Let’s dive into some advanced techniques that can save you time and effort.

Utilizing Tags And Notes

Tags and notes can add a new layer of detail to your expense tracking. They help organize and categorize expenses more effectively.

Tags allow you to label expenses with specific categories. This makes it easier to filter and sort transactions. For example, you can create tags for:

- Travel

- Meals

- Supplies

- Marketing

Using tags, you can quickly find all expenses related to a particular project or client. To add tags, simply go to the expense entry and look for the tags field.

Notes provide space for additional details about each expense. This can be useful for adding context or explanations. For instance, if you have a receipt for a business meal, you can note who attended and the purpose of the meeting.

Here’s how to use tags and notes effectively:

- Add tags to categorize expenses.

- Use notes to capture important details.

- Review tagged and noted expenses regularly.

Incorporating tags and notes can make your expense reports more comprehensive and easier to understand.

Integrating With Other Tools

Integrating QuickBooks with other tools can simplify expense tracking. Various tools can connect with QuickBooks to streamline data entry and reporting.

Here are some popular tools that integrate well with QuickBooks:

- Receipt capture apps: Tools like Expensify or Receipt Bank can automatically scan and upload receipts to QuickBooks.

- Bank feeds: Connecting your bank account to QuickBooks ensures that all transactions are imported automatically.

- Project management software: Tools like Trello or Asana can sync with QuickBooks to track project-related expenses.

Using these integrations, you can reduce manual entry and errors. For example, with receipt capture apps, you only need to take a photo of your receipt, and the app will handle the rest.

- Select the tool you want to integrate.

- Follow the setup instructions provided by the tool.

- Connect the tool to your QuickBooks account.

- Configure settings to match your needs.

Integrations can save time and improve accuracy. They ensure that all your expenses are captured and categorized correctly.

Frequently Asked Questions

How Do I Track Expenses In Quickbooks?

Tracking expenses in QuickBooks is easy. Go to the “Expenses” tab. Then, click “New Transaction” to record your expense. Fill in the required details and save.

Can Quickbooks Categorize My Expenses?

Yes, QuickBooks can categorize expenses automatically. You can set up rules for recurring expenses. This helps in organizing your financial data efficiently.

Is Quickbooks Good For Small Business Expense Tracking?

QuickBooks is excellent for small business expense tracking. It offers user-friendly features to manage and categorize expenses. This ensures accurate financial records.

How Do I Add Receipts To Quickbooks?

To add receipts, use the QuickBooks mobile app. Take a photo of your receipt. Then, upload it directly to your QuickBooks account.

Conclusion

Quickbooks Expense Tracking simplifies managing your business finances. It saves time. It reduces errors. You get a clear view of your spending. You can make better decisions. It’s user-friendly and efficient. Perfect for small businesses. Track every expense with ease.

Stay organized and stress-free. Quickbooks is a reliable tool. It helps your business grow. Start using it today. See the difference it makes. Happy tracking!