Managing your finances can be a daunting task, especially for small business owners. FreshBooks is here to simplify that process.

Designed for small businesses, accountants, and self-employed professionals, FreshBooks offers a range of features to make accounting tasks easier. FreshBooks is an accounting software that streamlines invoicing, expense tracking, and project management. It allows you to create professional invoices, manage expenses, and track billable hours effortlessly. With its mobile apps, you can access your accounts from anywhere, making it a flexible and efficient tool for managing your finances. The software also supports online payments, helping you get paid faster. Whether you are handling large volumes of billing or just starting out, FreshBooks has the tools you need to manage your financial tasks efficiently. To learn more about FreshBooks and its features, visit their website at FreshBooks.

Credit: www.youtube.com

Introduction To Freshbooks

FreshBooks is a leading accounting software designed to make accounting tasks easier for small businesses, accountants, and self-employed professionals. This blog post will guide you through FreshBooks, highlighting its main features and benefits. Let’s dive in!

What Is Freshbooks?

FreshBooks is an innovative accounting software aimed at simplifying complex accounting processes. It caters to small businesses, accountants, and freelancers, providing a user-friendly platform for managing finances.

With FreshBooks, you can handle invoicing, track expenses, manage projects, and generate financial reports. This software offers a comprehensive solution for all your accounting needs.

Purpose And Benefits Of Using Freshbooks

The main purpose of FreshBooks is to streamline accounting tasks, making them more manageable for non-accountants. Here are some key benefits:

- Ease of Use: Designed for simplicity, allowing users to manage finances without accounting expertise.

- Efficiency: Automates tasks, saving time and reducing manual effort.

- Flexibility: Suitable for various professional fields and business sizes.

- Accessibility: Mobile apps ensure you can manage your finances from anywhere.

FreshBooks offers a variety of features to enhance your accounting experience:

| Feature | Description |

|---|---|

| Invoice Software | Create, send, and manage professional invoices. |

| Expenses and Receipts | Track and organize expenses effortlessly. |

| Time Tracking | Monitor billable hours and manage time efficiently. |

| Managing Projects | Streamline project management and collaboration. |

| Online Payments | Accept payments online with ease. |

| Financial Reports | Generate detailed financial reports. |

| Mobile Apps | Access your account on the go with mobile apps. |

| High Volume Billing | Handle large volumes of billing efficiently. |

FreshBooks offers a special promotional pricing: 75% off for the first 3 months during the End of Year Sale. Visit the FreshBooks website for more details.

Getting Started With Freshbooks

Are you new to Freshbooks? This guide will help you get started quickly. Freshbooks simplifies accounting for small businesses, accountants, and freelancers.

Creating Your Freshbooks Account

To begin, visit the Freshbooks website and click on the “Get Started” button. You will need to provide your email address and create a password.

Follow these steps:

- Enter your email address.

- Create a strong password.

- Confirm your email by clicking the link sent to your inbox.

- Complete the initial setup by entering your business details.

Once your account is created, you can start exploring Freshbooks’ features.

Setting Up Your Business Profile

Setting up your business profile is crucial for accurate financial management. Follow these steps:

- Log in to your Freshbooks account.

- Navigate to the “Settings” menu.

- Select “Company Profile.”

- Fill in your business name, address, and contact information.

- Upload your business logo for a professional touch.

A well-completed business profile helps in generating professional invoices and financial reports.

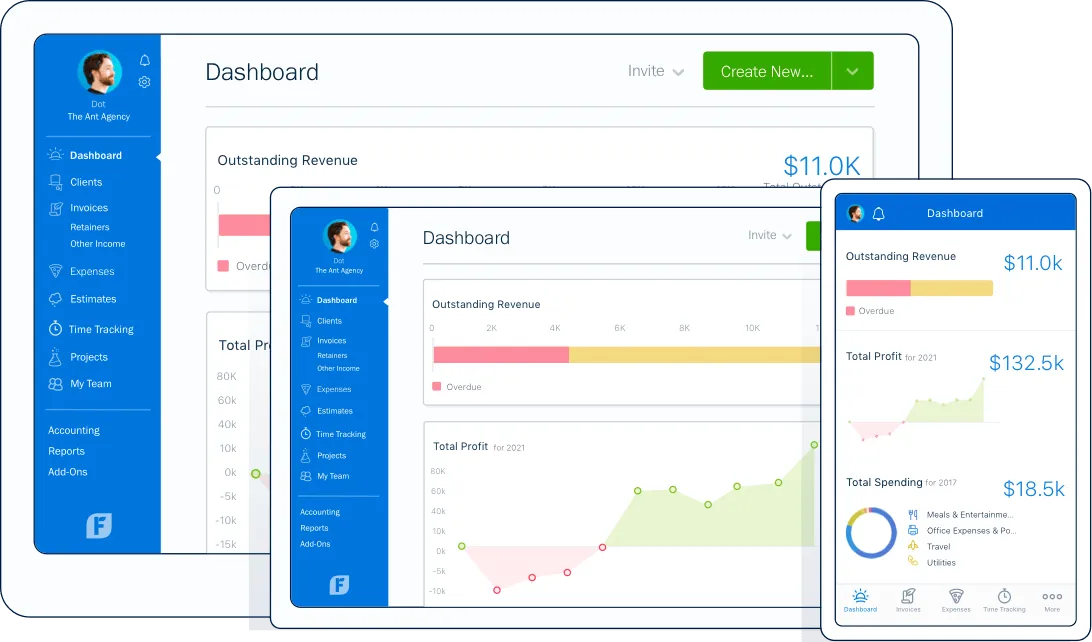

Navigating The Freshbooks Dashboard

The Freshbooks dashboard is user-friendly and intuitive. Here’s how to make the most of it:

- Dashboard Overview: Get a quick snapshot of your finances, including outstanding invoices and expenses.

- Invoices: Create, send, and manage your invoices effortlessly.

- Expenses: Track and categorize your business expenses.

- Projects: Manage your projects and collaborate with team members.

- Time Tracking: Monitor billable hours and track your time efficiently.

- Reports: Generate detailed financial reports to analyze your business performance.

Use the navigation menu to access these features and streamline your accounting tasks.

By following these steps, you can quickly get started with Freshbooks and simplify your accounting tasks.

Managing Invoices And Payments

Managing invoices and payments is crucial for any business. FreshBooks makes this process simple and efficient. This section will guide you through creating, sending, tracking, and managing invoices and payments using FreshBooks.

How To Create And Send Invoices

Creating and sending invoices with FreshBooks is straightforward. Follow these steps:

- Log in to your FreshBooks account.

- Navigate to the Invoices section from the dashboard.

- Click on Create New Invoice.

- Fill in the necessary details, including client information, invoice items, and payment terms.

- Review the invoice for accuracy.

- Click Send to email the invoice directly to your client.

FreshBooks allows you to customize your invoices with your logo and branding. This adds a professional touch and helps maintain consistency.

Tracking Invoice Status And Payments

Keeping track of invoice status and payments is essential. FreshBooks provides easy tracking:

- Go to the Invoices section.

- View the list of all your invoices and their statuses.

- Check whether an invoice is Sent, Viewed, or Paid.

- For overdue invoices, send reminders directly from FreshBooks.

FreshBooks also offers detailed reports to monitor your invoicing and payment history. This helps in financial planning and ensures timely follow-ups.

Setting Up Payment Gateways

Setting up payment gateways in FreshBooks is vital for receiving online payments. Follow these steps to set up payment gateways:

- Go to the Settings menu.

- Select Accept Online Payments.

- Choose your preferred payment gateway (e.g., PayPal, Stripe).

- Follow the instructions to link your FreshBooks account with the selected gateway.

- Ensure all settings are configured correctly to start accepting payments.

Offering multiple payment options can improve cash flow and customer satisfaction. FreshBooks supports various gateways to make this easy.

Using FreshBooks for managing invoices and payments simplifies your accounting tasks. This ensures that your business runs smoothly and efficiently.

Expense Tracking And Management

Managing expenses effectively is crucial for small businesses. FreshBooks makes this task simple and efficient. The software offers robust tools for recording, categorizing, and reporting business expenses. Let’s delve into how FreshBooks can streamline your expense management process.

Recording Business Expenses

Recording expenses in FreshBooks is straightforward. Follow these steps:

- Log in to your FreshBooks account.

- Navigate to the “Expenses” tab.

- Click on “New Expense”.

- Enter the expense details such as amount, date, and vendor.

- Upload a receipt if available.

- Save the expense.

FreshBooks allows you to attach receipts directly to each expense entry. This keeps your records organized and ensures all necessary documentation is in one place.

Categorizing And Organizing Expenses

Proper categorization helps you track where your money is going. In FreshBooks, you can categorize expenses easily:

- Open the expense you wish to categorize.

- Select the appropriate category from the dropdown menu.

- Save the changes.

Common expense categories include:

- Office Supplies

- Travel

- Meals and Entertainment

- Professional Services

- Advertising

Organizing expenses by category helps in generating accurate financial reports and monitoring spending patterns.

Generating Expense Reports

FreshBooks offers powerful reporting tools to help you understand your spending:

- Go to the “Reports” section in your FreshBooks account.

- Select “Expense Report” from the list.

- Choose the date range for the report.

- Customize the report by selecting specific categories or vendors.

- Generate the report and review your expenses.

You can export reports in formats like PDF or CSV for further analysis or sharing with your accountant.

FreshBooks simplifies expense tracking and management. The software ensures you stay on top of your business finances efficiently.

Time Tracking And Project Management

FreshBooks offers robust tools for time tracking and project management. These features help you manage your time and projects efficiently. Let’s dive into how you can use these features to stay organized and productive.

Using The Time Tracking Feature

The time tracking feature in FreshBooks lets you monitor billable hours with ease. This tool is essential for freelancers and small businesses. Here’s how to use it:

- Log into your FreshBooks account.

- Navigate to the Time Tracking section.

- Click on New Time Entry.

- Select the project and task you are working on.

- Enter the hours worked or use the timer to track time in real-time.

- Add any necessary notes for reference.

- Click Save to record your entry.

This feature ensures you accurately track the time spent on each project, helping you invoice clients correctly.

Managing Projects And Tasks

FreshBooks simplifies project management by allowing you to streamline tasks and deadlines. Follow these steps to manage your projects effectively:

- Go to the Projects tab in your account.

- Click on Create a New Project.

- Enter the project name and description.

- Add team members who will work on the project.

- Set deadlines and assign tasks to each team member.

- Track progress and make adjustments as needed.

This tool keeps your projects organized and ensures everyone knows their responsibilities and deadlines.

Collaborating With Team Members

Effective collaboration is key to successful project management. FreshBooks allows seamless team collaboration. Here’s how to collaborate with your team:

- Invite team members to your FreshBooks account.

- Assign roles and permissions based on their responsibilities.

- Share project details and deadlines.

- Use the Comments section to communicate and provide updates.

- Track each member’s time and task completion.

This feature ensures everyone stays on the same page, reducing miscommunication and increasing productivity.

Using these tools, you can efficiently manage your time and projects, ensuring all tasks are completed on schedule and within budget.

Financial Reporting And Analysis

Understanding your financial health is crucial for any business. FreshBooks makes financial reporting and analysis simple and effective. With FreshBooks, you can generate detailed reports, analyze business performance, and use insights for informed decision-making.

Generating Financial Reports

FreshBooks offers a range of financial reports that help you understand your business finances. The key reports include:

- Profit and Loss Statement: Shows your revenue, expenses, and profit over a specific period.

- Balance Sheet: Provides an overview of your assets, liabilities, and equity.

- Cash Flow Statement: Tracks the flow of cash in and out of your business.

These reports are generated with a few clicks, saving you time and ensuring accuracy.

Analyzing Business Performance

FreshBooks helps you analyze your business performance through its intuitive dashboard. Key performance indicators (KPIs) you can monitor include:

- Revenue Growth: Track your income over time.

- Expense Trends: Monitor your spending patterns.

- Profit Margins: Calculate the difference between your revenue and expenses.

These insights help you understand how your business is performing and identify areas for improvement.

Using Insights For Decision Making

With the detailed reports and performance analysis, FreshBooks empowers you to make informed decisions. Use the insights to:

- Budget Effectively: Plan your expenses and allocate resources wisely.

- Optimize Pricing: Adjust your pricing strategy based on profitability.

- Improve Cash Flow: Ensure you have enough cash to cover your obligations.

These informed decisions can help you grow your business sustainably and efficiently.

FreshBooks makes financial reporting and analysis accessible, even for those without an accounting background. By leveraging its powerful tools, you can gain a clear understanding of your business finances and drive better results.

Pricing And Affordability

FreshBooks offers an accounting software tailored for small businesses, accountants, and self-employed professionals. Understanding its pricing and affordability can help you choose the right plan for your business needs.

Freshbooks Pricing Plans

FreshBooks provides several pricing plans to cater to different business sizes and requirements. Each plan includes a set of features designed to make accounting tasks simpler and more efficient.

| Plan | Price | Main Features |

|---|---|---|

| Lite | $15/month | Invoices, Expenses, Time Tracking, Estimates, Tax Reports |

| Plus | $25/month | All Lite features + Double Entry Accounting Reports, Proposals |

| Premium | $50/month | All Plus features + Advanced Payments, Project Profitability |

| Select | Custom Pricing | All Premium features + Dedicated Account Manager, Custom Features |

Comparing Features Across Plans

Each FreshBooks plan offers a range of features. Comparing these features can help determine which plan best fits your business needs.

- Lite: Includes basic invoicing, expense tracking, and time tracking.

- Plus: Adds more robust accounting tools and proposal capabilities.

- Premium: Provides advanced payment options and project profitability insights.

- Select: Offers custom features and a dedicated account manager for larger businesses.

By evaluating these features, you can identify which plan aligns best with your business operations.

Choosing The Right Plan For Your Business

Choosing the right FreshBooks plan depends on your business size and specific needs. Here are some tips to help you decide:

- Identify Your Needs: Determine the features you need. For example, if you need basic invoicing, the Lite plan may be sufficient.

- Consider Your Budget: Evaluate how much you can afford to spend monthly on accounting software.

- Think About Growth: If you plan to grow, consider a plan that offers more advanced features.

- Utilize Promotions: Take advantage of promotions like the 75% off for the first 3 months to save on costs initially.

By following these tips, you can select a FreshBooks plan that provides the best value and functionality for your business.

For more detailed information on pricing, features, or to purchase, visit the FreshBooks website.

Credit: www.freshbooks.com

Pros And Cons Of Freshbooks

Freshbooks is a popular accounting software designed to simplify accounting tasks. Before deciding if it’s right for you, it’s important to weigh the pros and cons. This section explores the advantages and limitations of using Freshbooks.

Advantages Of Using Freshbooks

Freshbooks offers many features that make accounting easier and more efficient. Here are some key advantages:

- Ease of Use: Freshbooks simplifies complex accounting tasks, making it accessible for non-accountants.

- Invoice Software: Create, send, and manage professional invoices effortlessly.

- Expenses and Receipts: Track and organize expenses with ease.

- Time Tracking: Monitor billable hours and manage time efficiently.

- Managing Projects: Streamline project management and collaboration.

- Estimating Software: Generate and send estimates quickly.

- Online Payments: Accept payments online without hassle.

- Financial Reports: Generate detailed financial reports for better financial management.

- Mobile Apps: Access your account on the go with mobile apps.

- High Volume Billing: Handle large volumes of billing efficiently.

These features make Freshbooks a flexible and efficient tool for various professional fields and business sizes.

Limitations And Drawbacks

While Freshbooks has many benefits, it also has some limitations. Here are a few drawbacks:

- Limited Customization: Some users may find the customization options limited compared to other accounting software.

- Pricing: The cost can be high for small businesses, especially after the promotional period ends.

- Refund or Return Policies: There is no clear information on refund or return policies.

Considering these pros and cons will help you decide if Freshbooks meets your accounting needs.

Recommendations For Ideal Users

FreshBooks is an exceptional accounting software that simplifies complex tasks. It’s designed for small businesses, accountants, and self-employed professionals. Here are some recommendations on who would benefit the most from using FreshBooks and scenarios where it excels.

Who Should Use Freshbooks?

FreshBooks is perfect for those who need an easy-to-use accounting solution. It is ideal for:

- Small Business Owners: Manage invoices, expenses, and financial reports with ease.

- Freelancers: Track billable hours and manage client billing efficiently.

- Accountants: Access comprehensive accounting tools for accurate financial management.

- Consultants: Generate and send estimates quickly and accept online payments.

- Creative Professionals: Streamline project management and collaboration.

Scenarios Where Freshbooks Excels

FreshBooks shines in several scenarios, making it a versatile tool for various needs:

- High Volume Billing: Handle large volumes of billing efficiently. Ideal for businesses with multiple clients and transactions.

- On-the-Go Management: Access your account with mobile apps. Perfect for professionals who travel or work remotely.

- Detailed Financial Reports: Generate detailed reports. Useful for making informed financial decisions.

- Online Payments: Accept payments online with ease. Simplifies the payment process for both you and your clients.

- Project Management: Streamline project management and collaboration. Beneficial for teams working on multiple projects.

FreshBooks is a flexible and efficient solution for various professional fields and business sizes. It saves time with automation and streamlined processes, making it accessible for non-accountants.

For more detailed information on pricing, features, or to purchase, visit the FreshBooks website.

Credit: www.freshbooks.com

Frequently Asked Questions

How Do I Create An Invoice In Freshbooks?

Creating an invoice in FreshBooks is simple. Go to the “Invoices” section, click “Create New,” and fill in the required details.

Can I Track Expenses With Freshbooks?

Yes, you can track expenses easily. Just go to the “Expenses” tab, click “New Expense,” and enter the details.

Is Freshbooks Suitable For Small Businesses?

FreshBooks is ideal for small businesses. It offers user-friendly accounting features, invoicing, expense tracking, and time tracking.

How Do I Set Up Clients In Freshbooks?

To set up clients, go to the “Clients” section, click “Add Client,” and enter your client’s information.

Conclusion

Managing your finances is simpler with FreshBooks. This software takes the complexity out of accounting. Whether you run a small business or work independently, it helps. You can create invoices, track expenses, and manage projects easily. Plus, it offers convenient mobile apps for on-the-go access. Ready to simplify your accounting tasks? Check out FreshBooks today and experience a hassle-free way to handle your finances. Visit the FreshBooks website for more details.